Debtor Turnover Ratio

This ratio is important to both the company and the investors as it clearly reflects the companys effectiveness in converting the inventory purchases to final sales. You can depreciate an asset to spread the cost of the asset over its useful life.

Accounts Receivable Turnover Days

Receivable Turnover Ratio Ratiosys

1

A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income.

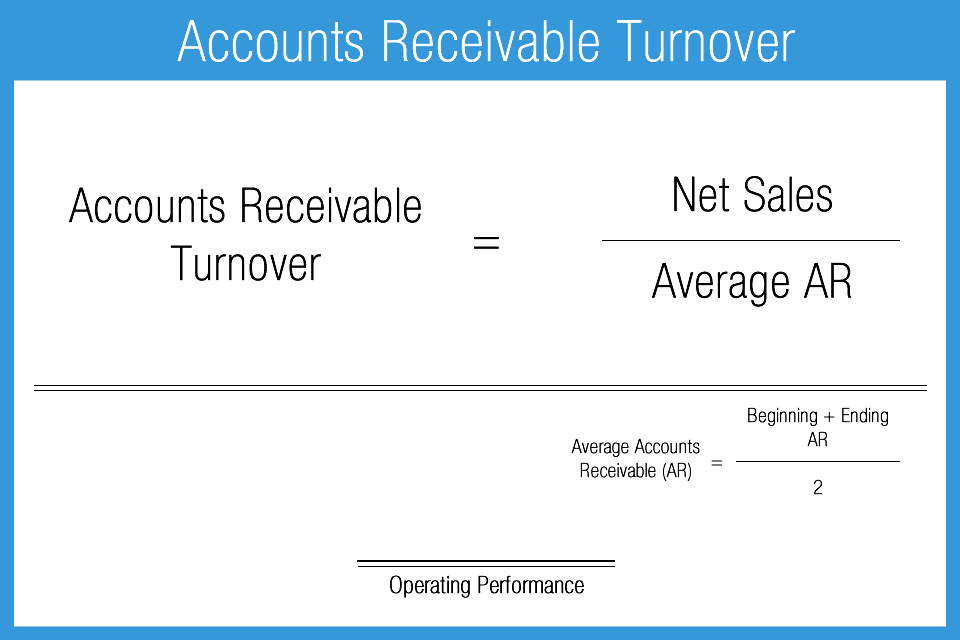

Debtor turnover ratio. Receivable Turnover Ratio or Debtors Turnover Ratio is an accounting measure used to measure how effective a company is in extending credit as well as collecting debts. Therefore the stock turnover ratio of the company for 2018 stood at 0968 times. The company has an excellent solvency ratio and is among the top 10 in this industry on this particular ratio.

Net Fixed Asset Turnover Ratio Sales Net Fixed Assets. Since a tax shield is a way to save cash flows it increases the value of the business and it is an important aspect of business valuation. It is a popular benchmark used in the measurement of an entitys ability to produce enough cash.

Example Debtors Collection Period Calculation. Depreciation the process of offsetting an asset over a period of time. It will be shown in the credit side of the Profit Loss account.

Low receivable turnover may be caused by a loose or nonexistent credit policy an inadequate collections function andor a large proportion of customers having financial difficulties. Debtors turnover ratio also called accounts receivable turnover ratio is a ratio that is used to gauge the number of times a business is able to convert its credit sales to cash during a financial yearThe collection period is the time taken by the company to convert its credit sales to cash. A low turnover ratio represents an opportunity to collect excessively old accounts receivable that are unnecessarily tying up working capital.

Asset Turnover Ratio 260174 million 338516 million. It is assumed that when you say balance sheet it includes entire fi. Stock Turnover Ratio 0968.

TBOS can provide a full accounts team under any recruitment business name however big or small. Both these ratios indicate the efficiency factor of the company in collecting receivables from its. Net Fixed Asset Turnover Ratio is calculated using the formula given below.

Disbursements money that a business. Accounts Receivable Days Days Sales Outstanding DSO. Default a failure to pay a loan or other debt obligation.

Accounts Receivable Turnover Accounts Receivable Turnover Ratio The accounts receivable turnover ratio also known as the debtors turnover ratio is an efficiency ratio that measures how efficiently a. However customers still need to pay LM2 12000. The debtors turnover ratio indicates making sales and realising the companys ability to make sales.

In the given case the company was having a debtors turnover of 4311 times in 2019 which is increased to 4396 in 2020. The accounts receivable turnover ratio also known as the debtors turnover ratio is an efficiency ratio Financial Ratios Financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company that measures how efficiently a company is collecting revenue and by extension how efficiently it is using its assets. The accounts receivables turnover ratio also known as debtors ratio is an activity ratio that measures the efficiency with which the business is utilizing its assets.

A credit rating is an assessment of the risk that a potential debtor will not repay his credit. Stock Turnover Ratio 300 million 310 million. Change in turnover The companys turnover has increased more than 20 since last.

Liquidity ratios are a class of financial metrics used to determine a debtors ability to pay off current debt. More Debt-to-Equity DE Ratio. Stock Turnover Ratio Formula Example 2.

Debtors finance See Factoring. Working capital turnover is a ratio comparing the depletion of working capital. Lets imagine our fictional business Learnmanagement bookshop LM2 sales turnover is 100000 for the year and they have received most of the money from customers for the books sold.

The debt service coverage ratio DSCR also known as debt coverage ratio DCR is the ratio of cash available for debt servicing to interest principal and lease payments. Debtor a person or business that owes you money. It measures how many times a business can turn its accounts receivables into cash.

Asset Turnover Ratio 077x. A higher debtors turnover will indicate high trade volumes Adjirackor et al 2017. Liquidity ratios are a class of financial metrics used to determine a debtors ability to pay off current debt obligations without raising external capital.

Our specialist back-office solutions are industry proven with many testimonials. TBOS celebrates 10 years in business providing comprehensive back office solutions that are tailored to the recruitment industry. Definition of Inventory Turnover Ratio.

If the accounts are made as per the new Schedule then the first heading is of Revenue. Let us take the example of Walmart Incs annual report for the year. A high ratio implies either that a company operates on a cash basis or that its extension of credit and.

The receivables turnover ratio is an activity ratio measuring how efficiently a firm uses its assets. For example because interest on debt is a tax-deductible expense taking on debt creates a tax shield. Inventory turnover ratio determines the number of times the inventory is purchased and sold during the entire fiscal year.

As per the annual report the following information is available. This ratio is an important indicator of a company which shows how well a company is able to provide credit facilities to its customers and at the same time is also able to recover the due amount within the payment period.

What Is The Receivables Turnover Ratio Fourweekmba

Accounts Receivable Turnover Ratio Accounting Play

9 Tips To Improve Your Accounts Receivable Turnover Enkel

Accounts Receivable Turnover Ratio Formula Calculation And Examples Youtube

What Is Debtor S Turnover Ratio Accountingcapital

Debtors Turnover Ratio Final

Accounts Receivable Turnover Ratio Top 3 Examples With Excel Template

Receivable Turnover Ratio Formula Meaning Example And Interpretation

Comments

Post a Comment